Dragon Under Fire: Geopolitical Heat Searing Chinese Equities

From the silk road to a geopolitical labyrinth, Chinese equities face mounting headwinds at home and from overseas.

The tectonic plates of Chinese geopolitics are shifting, sending tremors through domestic markets and casting long shadows on the nation's macro outlook. From the reverberations of a trade war with the US to the tremors of escalating tensions in the South China Sea, investors are left bracing for more policy-induced volatility.

This heightened uncertainty casts a long shadow on the nation's macro outlook, forcing a delicate balancing act between growth aspirations and geo-strategic objectives. However, the macro-level circumstances are not on China’s side.

A harsh geopolitical climate and hostile macroeconomic environment will therefore make it difficult for Chinese equities to bloom.

Capital Outflows

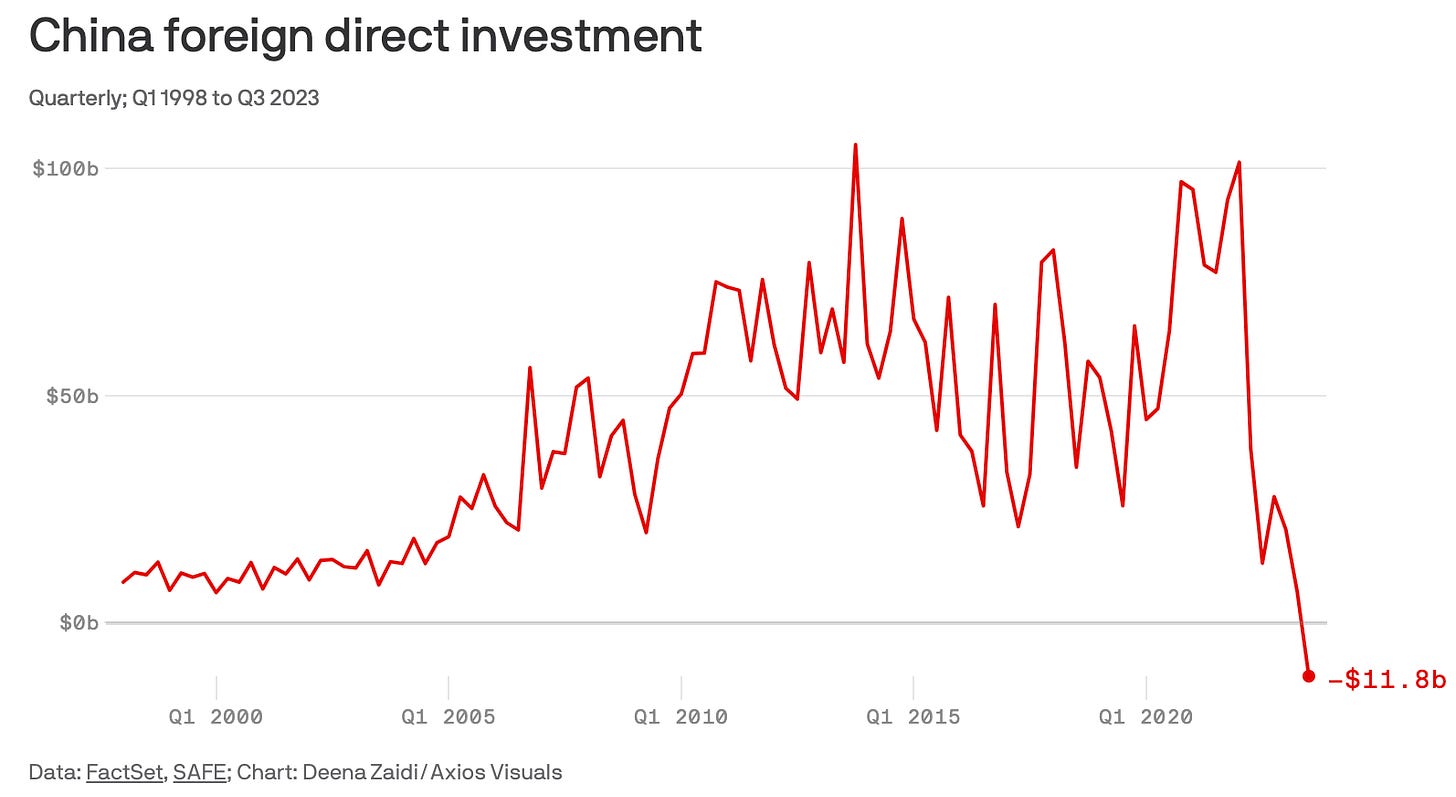

Back in November 2023, China recorded its first-ever quarterly deficit in FDI. This comes on top of Chinese corporate and household funds crossing the border to other countries exceeding inflows in 2023, marking the first capital flight in half a decade.

China's third-quarter 2023 saw a significant reversal in foreign direct investment (FDI), with a net outflow of $11.8 billion reported by the State Administration of Foreign Exchange (SAFE). This marks the first negative FDI figure recorded by SAFE since it began collecting data in 1998

This phenomenon is largely attributed to a mix of domestic and international pressures that have cast a shadow over the outlook for Chinese stocks. Let’s take a look at what those are and their effects.

Trouble at Home - Literally

At the heart of domestic concerns is the property market, which is integral to China's economy, accounting for 20% of its GDP and 70% of household wealth. The Asian giant’s over-reliance on debt-fueled growth has compromised its financial stability.

Its two largest property developers, Evergrande and Country Garden, have a collective debt exceeding $500 billion. Housing starts have fallen by more than 60 percent relative to pre-pandemic levels, a historically rapid pace only seen in the largest housing busts in cross-country experience in the last three decades.

According to the IMF: “Many developers have become non-viable but have avoided bankruptcy thanks in part to rules that allow lenders to delay recognizing their bad loans, which has helped mute spillovers to real estate prices and bank balance sheets”.

China's declining demographics further complicate the situation, reducing the demand for new housing as the population shrinks and urbanization slows.

The macroeconomic stress has been reflected in Chinese markets, which have lost about $7 trillion in market cap since 2021. State-backed buying scraped Chinese stocks from multi-year lows, but this will likely be more of a short-gain than a meaningful change in market direction. It is treating the symptom, not the problem.

Cheap fix, expensive repair.

Market analysts and investors maintain that financial injections into the market are not a sustainable solution, particularly in light of the real estate sector's continued impact on both consumer and investor confidence. And they’re likely right.

Measures aimed at market stabilization, including the implementation of restrictions on short-selling and reductions in trading fees, have thus far failed to arrest the decline.

This situation contrasts sharply with previous global market downturns, such as the burst of China's market bubble in 2015 and the trade war with the United States in 2018, highlighting the current challenges as more isolated incidents, primarily due to a significant withdrawal of international capital.

The reluctance of foreign investors to return complicates efforts to rejuvenate the market. Since their peak in 2021, onshore Chinese stocks have seen a substantial erosion of value, amounting to $4.8 trillion, amid a deepening property crisis, deflationary pressures, and extensive state intervention in the private sector.

Following a dismal start to the year, stock market indexes on the Chinese mainland did recently bounce back today after an investment institution directly under the country’s cabinet pledged to substantially hike its holdings of exchange-traded funds to shore up a sluggish stock market and spur investor confidence.

According to Li Xunlei, chief economist at Zhongtai Securities, Central Huijin’s commitment to buying more ETFs will stabilize the market and boost investor confidence. However, this does little to inject long-term confidence in China’s markets.

If anything, the necessity of coordinated, large-scale capital injections only highlights the instability of the situation more. What China needs to do is what it can’t: change its geopolitical strategy at home and overseas.

Foreign Pressures

De-risking, a tasteful euphemism for decoupling, has been putting pressure on Chinese equity markets and further dampening the macroeconomic outlook. Specifically, the recent explosion of industrial policies in the US and EU.

Washington and Brussels are crafting ABC (Anything but China) supply chains to de-centralize China out of the global supply chain for critical minerals. By doing so, it would “de-risk” them from China’s geoeconomic orbit and weaken the gravitational pull of their economy.

The tech-for-tat trade war with the US over semiconductors and restriction of other advanced equipment is also slowing Beijing's technological progress. You can read more about those in previous Weekly Insights:

AI Craze Boosting Demand for Chips, But Geopolitical Risks Linger

The Geopolitics of AI: Large Language Models

US Extends Chip Controls on China, What Now?

Quantum Computing: Investment Vehicle, Novel Geopolitical Risk, or Both?

These foreign pressures are compounding China’s internal struggles at a time when aligned multilateralism would help Beijing stabilize its economy. Unfortunately, Xi Jinping’s nationalism and polemics about self-sufficiency are only digging a bigger hole.

This doesn’t even take into account the centralization of power creating higher threshold for sudden-move policy risks for foreign and domestic investors with exposure to Chinese equities.

Businesses are pulling out of China not only due to compliance issues with their host countries but Beijing's increasingly draconian, security-first regulations. China’s opaque bureaucracy and aforementioned centralization of power have only served to isolate the Asian giant further at a time when it needs more integration.

Additional access to capital markets and the restoration of comparatively more business-friendly conditions would help support China’s fragile economy. Doing so, however, would require it to adjust its current geopolitical trajectory, and that is highly unlikely to happen.

Overall, the prognosis for Chinese equities and macroeconomic trends do not look favorable - and geopolitics are playing a big role in shaping that outlook.

Stay up to date and subscribe below.