Two Systems, One Future: The AI Chip Bifurcation

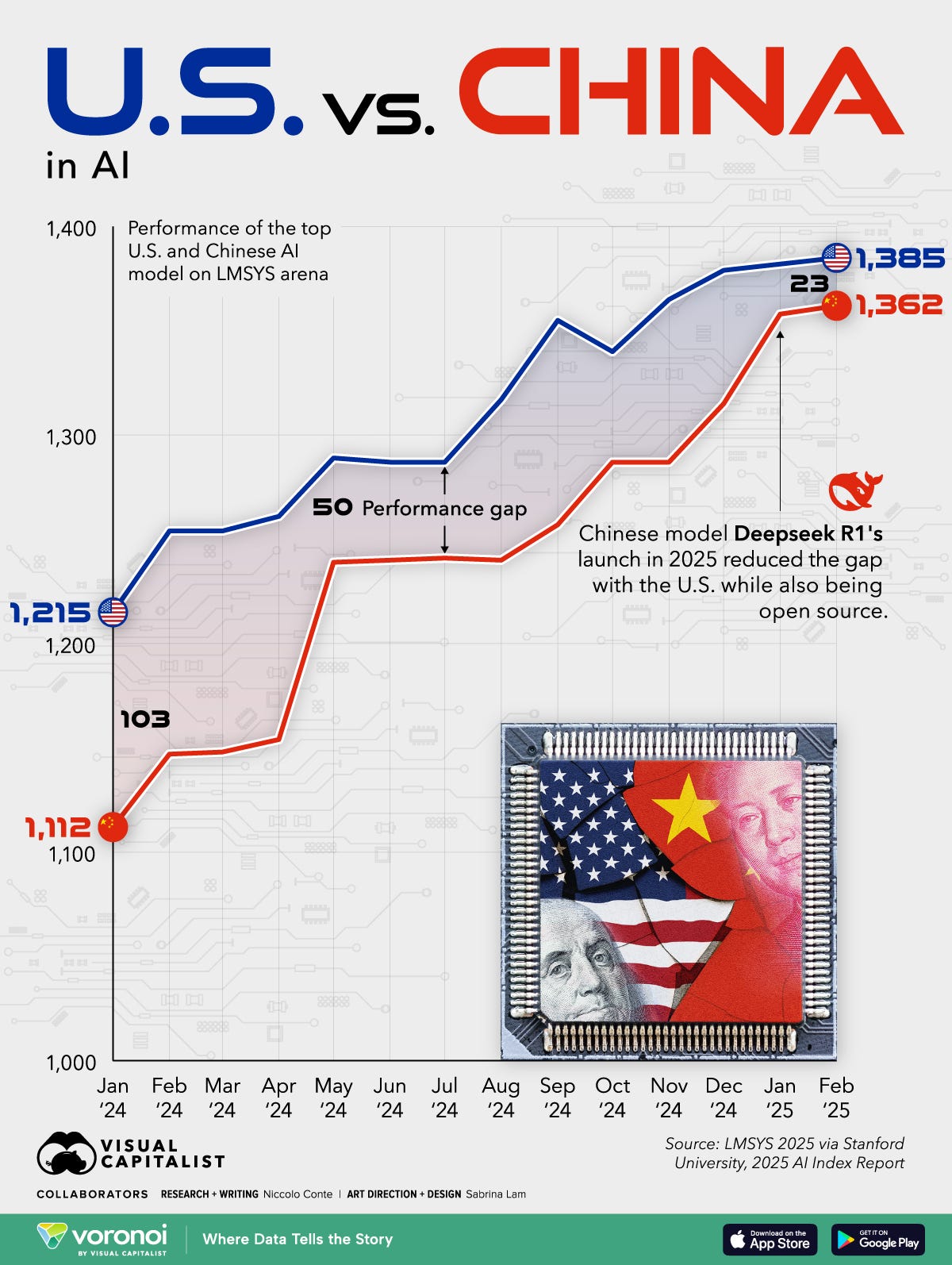

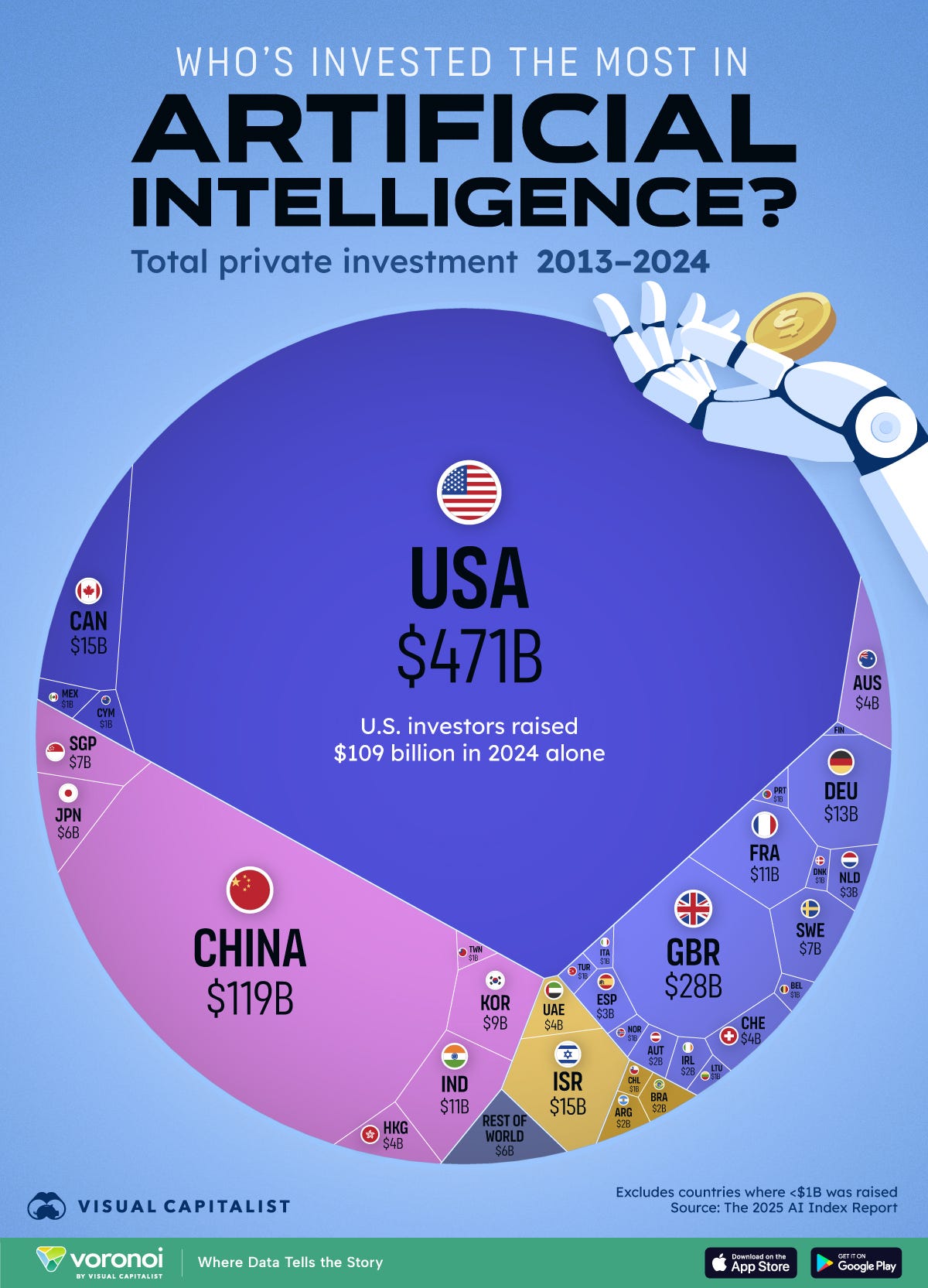

The United States and China are entering a period of geopolitical and technological decoupling that is reshaping the global semiconductor and AI hardware landscape.

After decades of interdependence, by 2026 the world is on track to see a bifurcated AI hardware ecosystem split along US–China lines. Strategic competition and national security concerns have spurred each country to bolster domestic capabilities while restricting tech flows to the other side.

This secular trend echoes Cold War-era tech bifurcation – when Western export controls (like the CoCom regime) denied the Soviet bloc cutting-edge technology – but on a far larger economic.

Washington and Beijing are now engaged in an intensifying contest over advanced chips, supercomputing GPUs, lithography tools, and AI accelerators. The result is two parallel innovation tracks: one led by the US and its allies, and another led by China, each with its own companies, standards, and supply chains.

This report provides an analytical overview of how industrial policies, corporate strategies, and export controls are driving this split, with examples of key companies (NVIDIA, Huawei, SMIC, AMD, Intel, etc.), major policies (the US CHIPS Act, China’s Made in China 2025, subsidies), and technological rivalries (AI chips, GPUs, lithography, accelerators).

It also examines loopholes in export controls (e.g. NVIDIA’s modified China-only chips, ASML’s DUV sales) and the spillover effects on third countries (ASEAN, EU, India). The implications of this bifurcation for AI markets, global tech collaboration, and geopolitical competition are profound and long-lasting.

Splitting Silicon: The US–China AI Hardware Divide Deepens

Both Washington and Beijing have implemented aggressive industrial policies to secure their positions in semiconductor technology, effectively laying the groundwork for separate ecosystems. In the US, the CHIPS and Science Act of 2022 authorized a historic investment of $280 billion aimed at revitalizing American tech manufacturing and R&D.

This included $52.7 billion in subsidies and tax credits for domestic semiconductor fabrication and robust funding for AI, quantum computing, and other advanced research.

By subsidizing new chip fabs on US soil, Washington seeks to reverse a decline in its chip manufacturing base (down to ~12% of global output in recent years) and reduce reliance on East Asian foundries. Major US firms like Intel have capitalized on these incentives – for instance, Intel was awarded $7.3 billion in CHIPS Act funding in 2023 to expand its Ohio fabs.

The U.S. National Security Strategy now explicitly frames cutting-edge semiconductors as vital to economic and military strength, warranting government intervention. This strategic prioritization marks a shift from the free-market era when US firms freely offshored production; national security now takes precedence over commercial considerations.

In parallel, China’s industrial policy has long targeted semiconductor self-sufficiency, and these efforts have only redoubled amid US pressure. The “Made in China 2025” plan identified semiconductors and AI as strategic sectors in which China aimed to achieve 70% self-sufficiency by 2025.

In reality, that target has proven overly ambitious – analysts estimate China will reach only around 30% self-sufficiency by 2025, far below the goal. Nevertheless, Beijing has poured immense resources into closing the gap.

Multiple state-backed funds and subsidies support domestic chip firms. For example, government support for major Chinese chip companies (like SMIC, Huawei’s HiSilicon, Naura, etc.) reached ~¥20.5 billion ($2.8 billion) in 2023, up 35% from the year prior.

Local governments have launched semiconductor investment funds (such as the Shanghai Integrated Circuit Fund, recently doubled to $2 billion) to foster indigenous innovation. Beijing’s National IC Investment Fund (“Big Fund”) has invested tens of billions over the past decade, and a new tranche of ~$40 billion was announced in 2023 to counter US export controls.

Tax breaks, R&D grants, and talent programs further underpin China’s push. The message from Beijing is clear: reducing dependence on foreign (especially American) tech is a top strategic priority.

These dueling industrial policies are catalyzing a divergence in supply chains. The US is incentivizing its allies and companies to onshore production or source from friendly nations. For instance, Taiwan’s TSMC – the world’s leading chip foundry – is investing $40 billion in new fabs in Arizona (two plants planned for 4 nm and 3 nm nodes) after US lobbying.

South Korea’s Samsung is similarly investing $17 billion in a Texas fab. Meanwhile, China is striving to localize its entire semiconductor value chain, from chip design tools to fabrication to packaging.

Both sides are effectively ring-fencing their tech ecosystems with government aid, accelerating the creation of distinct “tech stacks” by 2026. One is centered on the US and partners such as Taiwan, South Korea, Japan, and Europe, while the other is increasingly centered within China’s sphere.

Export Controls, Sanctions and Loopholes

A major driver of the bifurcation is the US campaign of export controls and sanctions to deny China the highest-end semiconductors and equipment. The chart below is key insight into the export controls the U.S. is imposing and how it is affecting Nvidia:

Keep reading with a 7-day free trial

Subscribe to Pantheon Insights to keep reading this post and get 7 days of free access to the full post archives.