Diverging Markets and Data Points of Decoupling

Geopolitical dynamics are already shaping market data and projections, revealing a clear trend toward fragmentation in the global semiconductor landscape.

China’s reliance on foreign semiconductors, while still significant in 2025, has begun to decline. In 2020, over 80% of the semiconductors consumed in China were imported, measured by value.

Since then, domestic production has made modest gains. By 2023, China’s self-sufficiency was estimated at around 15%, with forecasts suggesting it could rise to between 20% and 30% by the middle of the decade. Although this remains far below the 70% target outlined in the Made in China 2025 initiative, the direction of travel is clear.

Each percentage point of increased domestic output by firms such as SMIC, Hua Hong, and YMTC represents a corresponding decrease in market share for foreign suppliers. For the United States, this signals a growing loss of access to the world’s largest semiconductor market.

U.S. companies are already feeling the impact. The export restrictions imposed in October 2022 significantly curtailed sales to China. Companies like NVIDIA and AMD lost hundreds of millions of dollars in potential revenue as Chinese firms were barred from purchasing their top-tier GPUs.

The Chinese market has become increasingly inaccessible for the most advanced American chips, and even mid-tier products are facing rising competition from domestic Chinese alternatives.

Looking ahead to 2026, industry forecasts suggest China could be capable of meeting approximately one-third of its own semiconductor demand through domestic production. The remaining two-thirds and the high-end global market will still be dominated by the U.S. and its allies.

This divergence is particularly evident in the AI chip market. The global AI accelerator sector, encompassing GPUs and NPUs, is expected to grow rapidly through 2025 and 2026, but the market is clearly splitting along geopolitical lines.

Currently, NVIDIA controls an estimated 80% to 90% of the global AI accelerator market. However, its share in China is collapsing due to ongoing export bans. As a result, domestic Chinese players are moving quickly to fill the void.

By 2026, the market may look something like this: over 75% of AI accelerator shipments within China will be from Chinese-designed chips. U.S. firms like NVIDIA and AMD will effectively account for zero percent of Chinese shipments but maintain around 95% of shipments to the rest of the world.

In 2023, NVIDIA shipped roughly 3.8 million data-center GPUs, representing 98% of the global market. Virtually all of these went to non-Chinese buyers or entities exempt from sanctions.

Meanwhile, Chinese cloud service providers such as Alibaba and Baidu are turning to domestically developed chips or relying on legacy NVIDIA stock already in hand.

By 2026, this trend is expected to intensify, with the AI hardware market becoming increasingly regionalized, with one ecosystem centered around China and another around the U.S. and its allies.

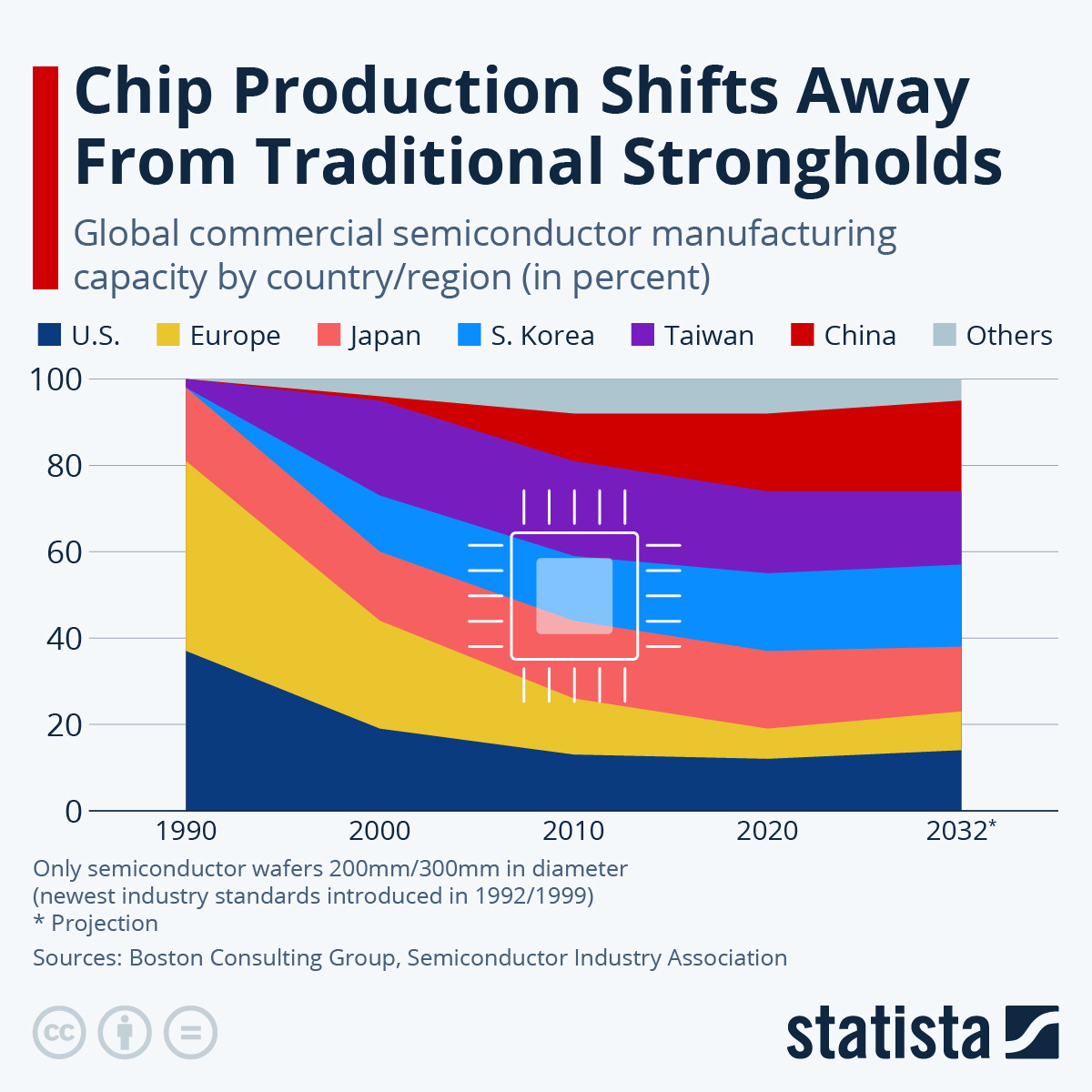

In terms of manufacturing capacity, China has been steadily expanding its share of global wafer production, primarily at mature nodes of 28 nm and above.

Industry projections suggest that, if current investment trends continue, China could account for more than 20% of global chip production capacity by 2030, up from approximately 15% in 2020.

However, most of this capacity is focused on older technologies used in sectors such as automotive electronics and the Internet of Things. The most advanced manufacturing of sub-10 nm nodes, which are critical for high-performance AI chips, remains overwhelmingly concentrated in Taiwan, where TSMC leads, and in South Korea with Samsung.

In response, the United States has moved to onshore portions of this cutting-edge production through the CHIPS Act. By 2026, U.S. domestic chip fabrication capacity for advanced nodes is expected to roughly triple from 2020 levels, albeit from a relatively low starting point.

Projects like TSMC’s 3 nm fab in Arizona and Intel’s planned 4 nm and 3 nm lines in Ohio are central to this effort. These developments will result in a greater share of high-end chip production taking place on U.S. soil or within the territory of close allies. This will further insulate the Western AI supply chain from potential disruptions involving China.

Meanwhile…

Keep reading with a 7-day free trial

Subscribe to Pantheon Insights to keep reading this post and get 7 days of free access to the full post archives.