Will Defense Stocks Surge on Escalating Geopolitical Tension?

Geopolitical pressure is swelling globally amid the US-China rivalry, and defense contractors will likely benefit from increased security risks

Defense contracting companies may see their stock prices surge as geopolitical risks raise the premium for military security. The US-China rivalry is arguably the biggest catalyst behind this geopolitical-financial dynamic and will likely continue to provide a tailwind for military equities.

The Macro-Geopolitical Context

Geopolitical volatility continues to feature as the preeminent headline risk businesses are concerned about, particularly as it relates to US-Sino relations. The sheer size of both economies means an atrophy in bilateral relations - and the subsequent fallout - is not confined to two parties.

China’s centrality in the global supply chain system for strategic metals and the US’s dollar-centric paradigm means policy out of these two superpowers has multi-iterated consequences. Both parties have leveraged their respective economic domains to exert pressure on adversaries.

A precedent of weaponizing interdependence has already been set. But economic means may give way to military alternatives.

As the underlying distrust fueling these confrontational dynamics grows, spending on defense and investment in dual-use technologies - civilian and military - will also expand at a commensurate rate. States will spend more on defense not just as a result of an immediate threat or invasion but also the perception of an incoming threat.

In this context, the US-China rivalry will play a big role in pushing defense stocks higher as diplomacy fails and Beijing’s rhetoric becomes more bellicose, and its policies more antagonistic.

Arming the World

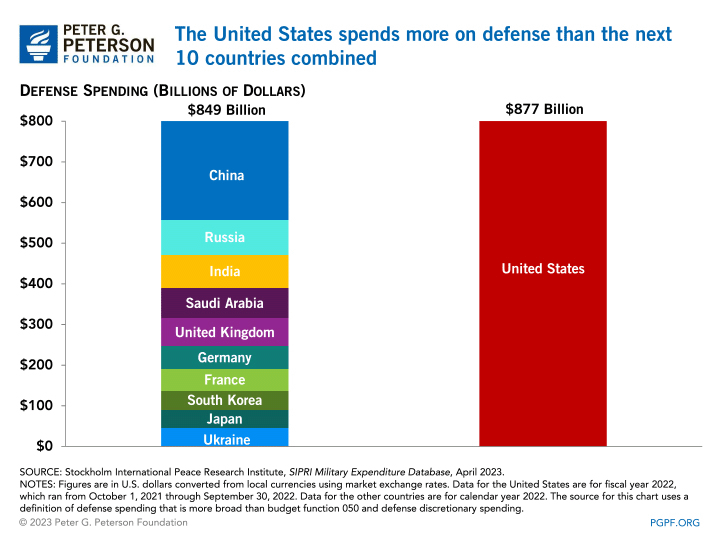

Global military expenditures rose by 3.7% in real terms in 2022, to reach a record high of $2.24 trillion. Global spending grew by about 19% between 2013–22 and has risen every year since 2015. The US continues to boast the highest defense spending of any country: as of April 2023, it spent $877 billion, more than the next 10 countries combined.

While the graph above suggests the second biggest one is China just under $300 billion, the figure may be much higher. U.S. Sen. Dan Sullivan’s estimates put the Chinese annual defense budget closer to actually around $700 billion, according to a report by Foreign Policy.

The reasons behind this has to do in large part with cost differentials: “wages and other costs are far lower in China: An American truck driver, for example, earns a starting salary of $40,000 per year, more than five times as much as his Chinese counterpart, who earns only about 54,000 yuan ($7,400 at the market rate)”.

Economic digression aside, Chinese defense spending will likely continue to grow as Sino-Western relations deteriorate. Shunned diplomatic channels will result in more coercive, targeted economic measures. The US-China tech-for-tat trade war is just one example of what happens when diplomacy fails: distrust grows, and coercive economic tactics follow on the basis of national security.

Asia: The Flashpoint

Consequently, as China “de-risks” from the West, it will also unhinge itself from a global institutional framework oriented around preventing geopolitical unilateralism. And the area where we will see this most clearly is in the South China Sea.

The Indo-Pacific region is at risk of becoming flashpoint of this hegemonic rivalry, and regional states want to prepare for what could be a devastating conflict. Washington’s five treaty allies in the region - Japan, South Korea, Australia, the Philippines, and Thailand - have the US as their largest foreign defense supplier.

Source: Statista

Allies in the Indo-Pacific region have become increasingly alarmed by the escalation in tensions and Chinese aggression, and will likely continue building up their defense capabilities through increased military spending. In 2022, military spending in East Asia - minus North Korea - was just shy of $400 billion.

Arms imports by East Asian states increased by 21% between 2013–17 and 2018–22. Arms imports by China rose by 4.1% with most coming from Russia. As relations with Washington continue to sour, Beijing’s and Moscow’s coordination and cooperation will deepen and widen in areas relating to military security.

However, the biggest increases in defense spending in East Asia were by US treaty allies South Korea (+61%) and Japan (+171%). But this trend spans across to West Asia as well.

Three of the top 10 importers in 2018–22 were in the Middle East: Saudi Arabia, Qatar and Egypt. The great majority of arms imports to the Middle East came from the US (54%). In other words, as global geopolitic tensions rise, countries will want to arm themselves - and the US has the supply to meet the demand.

Why US Equities?

The US boasts the largest defense contracting companies, and is the world’s biggest arms supplier. The post-WWII system designed by Washington is dependent upon a robust US military able to project its power overseas to secure trading lanes and accelerate globalization efforts.

High military spending is therefore an embedded feature of maintaining the global security architecture. Defense spending in the US will therefore always carry a structurally-higher threshold compared to other countries.

Lockheed Martin, the world’s biggest defense contractor, has seen their stock price rise close to 800% over the past 20 years. The average annual return for this stock over the 20-year period is approximately 19.09%. For reference, the S&P 500 had an annual average return of 9.75% (7.03% when adjusted for inflation) over the same period.

Foreign policy and the public sector in this regard exert tremendous influence in driving these returns. For example, Lockheed Martin received over 10% of all spending by the DoD in 2022 alone.

Over the past 20 years, there has been a number of geopolitical entanglements that have buttressed gains in military stocks. These include but are not limited to the: Iraq War, War on Terror, Russian conflict in Ukraine (annexation in 2014 and invasion in 2022), Syrian Civil War, etc.

Following the invasion in Ukraine, there was a 13 percent rise in defense spending in Europe, the sharpest in at least 30 years. The Stockholm International Peace Research Institute (SIPRI) also found that countries stepped up military spending in response to perceived Russian threats.

Looking ahead, while past performance is not indicative of future results, a period of heightened geopolitical tensions may induce policy-driven volatility across asset classes; but defense stocks may catch a windfall from this very same dynamic.